Table of Content

Try a free agent matching service like Clever Real Estate , who connects you with top local agents from name-brand brokerages and pre-negotiates lower listing fees on your behalf. Clever sellers get full service and support for a 1% listing fee vs. the typical 2.5-3% rate. That often translates to tens of thousands of dollars in savings at the closing table. For every real estate transaction, both a buyer and a seller, have to split the closing costs.

If you have any outstanding mortgage balance, or if you took a home equity line of credit or loan, all these dues will have to be paid back prior to closing. In these states, the closing attorney would generally take the place of an escrow company or other settlement agent. Typically $25 to $50, if any, to reimburse the escrow agent for bank fees. Proven strategies like shopping around for lower rates and working with a low commission realtor. Your monthly payment is higher, as is the overall cost of your home loan.

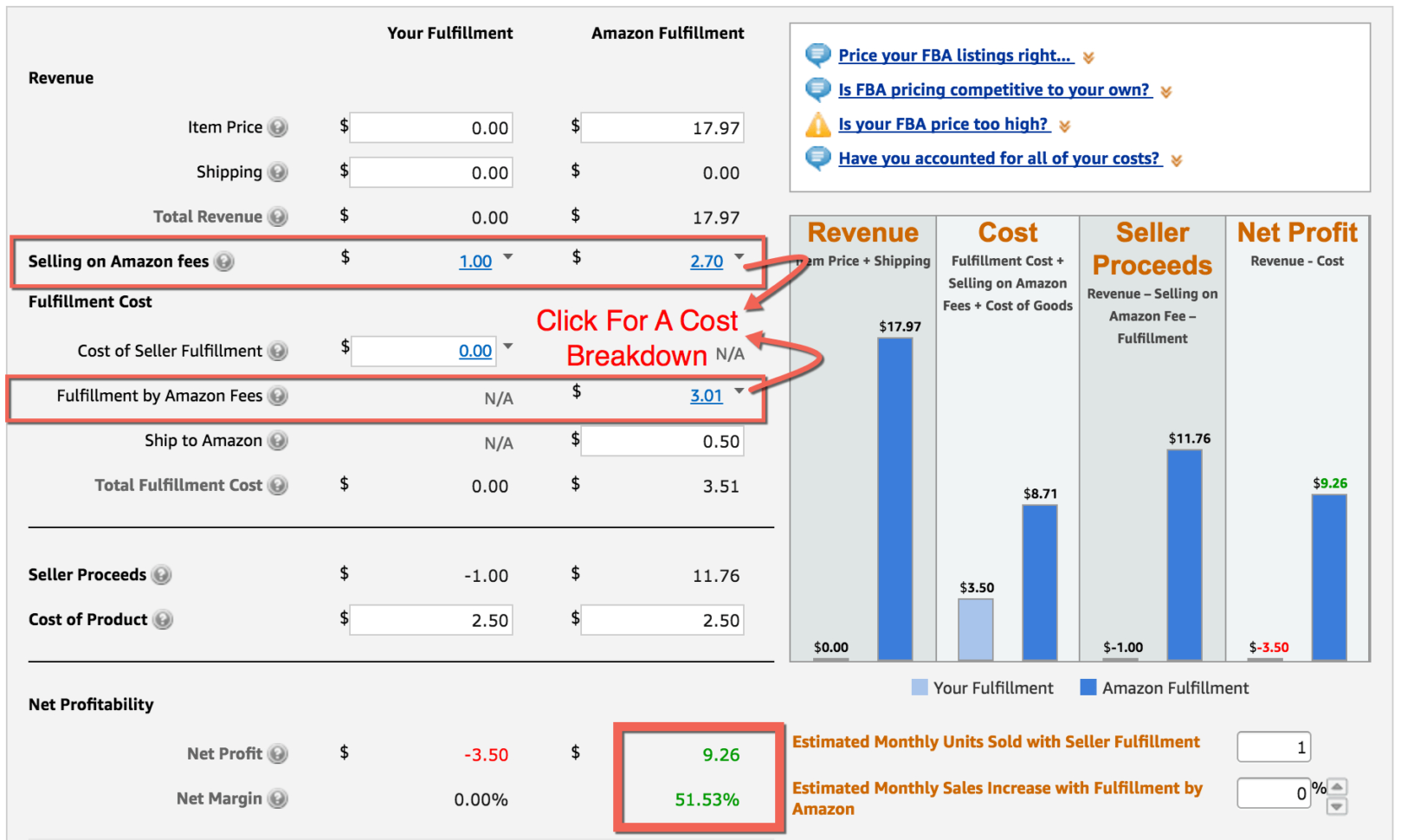

Title examination fee: 0.7% of sale price

These fees are used to pay for legal and administrative expenses such as real estate agent commission, loan origination, etc. Usually, a seller pays closing costs, but some deals also lead to the buyer’s closing costs. A seller usually pays 6% to 8% of the sale price towards closing costs, but in some cases, the closing costs may reach up to 12% of the sale price excluding closing outstanding loans. Sellers pay some closing costs in North Carolina, such as transfer taxes, their share of pro-rated property taxes, and realtor commissions. But North Carolina buyers normally pay a larger portion of the total closing costs due to loan-related fees. The biggest fee you’ll pay is real estate commission — at 5–6% of the sale price, realtor fees account for more than half of your estimated seller closing costs.

There are many ways to prepare and redecorate a home to make it look like new. Doing so helps sell the house sooner at a more favorable price. In some markets, you are required to hire a closing attorney as part of the selling process. The cost of a closing attorney deducts an additional $800-$1,200 from your profit.

Land transfer tax (up to $3,

The Federal Truth in Lending Act requires that every consumer loan agreement disclose the APR. Since all lenders must follow the same rules to ensure the accuracy of the APR, borrowers can use it as a good basis for comparing loan costs. For example, a 30-year fixed-rate loan has a term of 30 years. Real estate commissions are often the most considerable expense you'll have when selling. You can lower that cost by choosing a low-commission realtor.

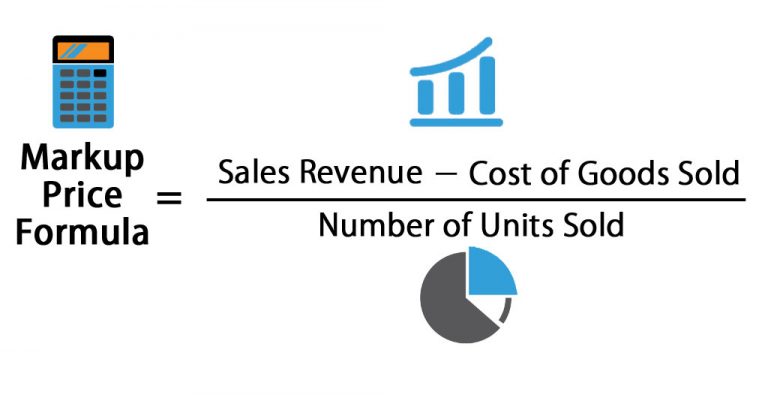

Sellers commonly take care of transfer taxes, HOA fees, and realtor commissions. Three days prior to closing, the seller receives a closing disclosure where the seller can see all the details about the deal including expenses. The commission to the real estate agent is 4%, transfer tax fee of 1%, payment of remaining mortgage of $60,000, and payment towards repairs of $1,000. Use this seller closing costs calculator to estimate how much you’ll owe in taxes and fees when you sell your home. The default values in the calculator are based on national averages. The fees you’ll actually pay will depend on where you’re selling.

Connecticut conveyance tax (varies)

If your house does have foundation problems, you’ll likely have to get it fixed. That said, it’s worth getting it fixed so you can sell the home at a favorable price. Consider making small renovations that add value at minimal cost. Around 83 percent of buyers’ agents state that home staging made it easier for a buyer to visualize property as a future home. This is according to a 2019 profile by the National Association of REALTORS® Research Group. For every $100 spent on staging a house, a seller can potentially recoup around $400.

The standard practice in Connecticut is that the seller pays all the transfer taxes . So it’s possible to negotiate those fees with a willing buyer. The Connecticut conveyance tax (a.k.a. real estate transfer tax) is due when real property title/ownership changes. That means different portions of the total home sales price may be taxed at different rates. In Connecticut, a licensed attorney typically handles closings, The attorney drafts and prepares closing documents that affect title transfer and legal rights.

It protects homeowners from getting sued if someone else claims to be the lawful owner of the property. You won’t pay state sales tax on your home sale since Texas has no income tax. The amount varies depending on whether it’s short-term or long-term . These fees cover the costs of recording the deed and other necessary documents with the county. Finally, staging is an important step in attracting people to purchase your home. While it’s necessary, beware of spending too much in the process.

In some cities, you might pay thousands just to transfer the title of the home to the new owner, while in other areas it’s free. It’s important to understand your regional burden, as well as who usually pays closing costs in the transaction and when they’re due. Florida seller closing costs can vary considerably by county and circumstance. Our calculator can help you ballpark your closing costs and net proceeds.

The average closing cost percentage ranges from about 1.5–2.4% for buyers. Closing cost responsibilities are negotiable, and offering to help the buyer cover their closing costs can be a valuable bargaining chip. While sellers can cover their closing fees out of the sale proceeds, buyers must pay theirs out of pocket. Sellers and buyers pay closing costs in South Carolina, but those expenses differ. Buyers normally pay loan-related fees, title costs, administrative fees, and various third-party expenses.

In some states, real estate closings must be performed by an attorney. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site.

Typically the buyer pays closing costs, though sometimes negotiations between the buyer and the seller can lead to the seller paying some of the closing costs. Most sellers use a listing agent to help sell their homes, with an average cost of 2.86% in North Carolina. Many qualified realtors now partner with agent matching companies to offer their services at lower rates.

No comments:

Post a Comment